Ault Alliance Stock: A High-Risk, High-Reward Investment Opportunity

Ault Alliance Inc. (AULT) is a company that operates in various sectors, such as aerospace, defense, energy, healthcare, and technology. The company claims to have a diversified portfolio of products and services that are innovative, disruptive, and scalable. The company also claims to have strategic partnerships and alliances with leading industry players and government agencies.

However, the company has also been involved in several controversies and lawsuits, such as:

- In 2019, the company was sued by the Securities and Exchange Commission (SEC) for allegedly conducting a fraudulent scheme that raised over $25 million from investors by making false and misleading statements about its business operations, financial condition, and prospects.

- In 2020, the company was sued by several former employees and contractors for allegedly failing to pay wages, commissions, bonuses, and expenses.

- In 2021, the company was sued by several shareholders for allegedly violating federal securities laws by making false and misleading statements about its business operations, financial condition, and prospects.

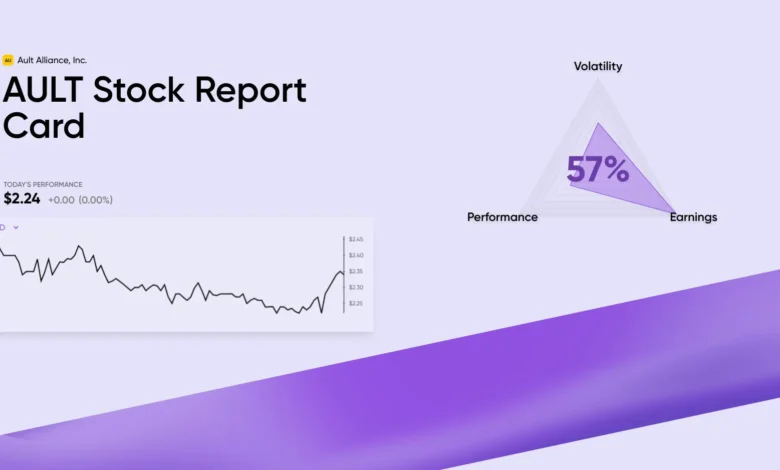

The company’s stock price has also been highly volatile and erratic, ranging from a 52-week high of $117 to a 52-week low of $2.18. The company’s market capitalization is currently around $3 million, which is very low for a company that claims to have a global presence and a diversified portfolio

Pros and Cons

Investing in Ault Alliance stock may have some potential pros and cons, such as:

- Pros:

- The company may have some innovative and disruptive products and services that could generate significant revenue and growth in the future.

- The company may have some strategic partnerships and alliances that could provide access to new markets and opportunities.

- The company may benefit from the increasing demand for products and services in the sectors that it operates in, such as aerospace, defense, energy, healthcare, and technology.

- The company’s stock price may be undervalued due to the negative publicity and lawsuits that it faces.

- The company’s stock price may experience a sharp increase if it resolves its legal issues and proves its business viability.

- Cons:

- The company may face significant legal risks and liabilities that could result in fines, penalties, sanctions, or injunctions.

- The company may face significant operational risks and challenges that could affect its ability to deliver its products and services.

- The company may face significant financial risks and difficulties that could affect its liquidity, solvency, profitability, and growth.

- The company may face significant competitive risks and pressures from other players in the sectors that it operates in.

- The company’s stock price may experience a sharp decline if it fails to resolve its legal issues or prove its business viability.

Conclusion

Ault Alliance stock is a high-risk, high-reward investment opportunity that may appeal to some investors who are willing to take on the uncertainty and volatility that it entails. The company has some potential strengths and opportunities that could make it a successful player in various sectors. However, the company also has some serious weaknesses and threats that could make it a failed venture. Investors who are interested in Ault Alliance stock should do their own research and due diligence before making any investment decisions.