Russell 2500: A Smid-Cap Index for Diversified Investors

The Russell 2500 Index is a stock market index that tracks the performance of 2,500 small-cap and mid-cap companies in the United States. The index is part of the Russell family of indexes, which are widely used by investors and fund managers as benchmarks for different segments of the US equity market. The Russell 2500 Index covers about 15% of the total US market capitalization and represents a broad and diversified exposure to the small to mid-cap segment, commonly referred to as “smid” cap. In this article, we will explore the meaning, composition, characteristics, and benefits of the Russell 2500 Index.

What is the Russell 2500 Index?

The Russell 2500 Index was launched on July 1, 1995, by FTSE Russell, a leading global index provider. The index is designed to be broad and unbiased in its inclusion criteria, and it is reconstituted annually to account for the inevitable changes that occur as stocks rise and fall in value. The index is calculated using a float-adjusted market capitalization weighting method, which means that only the shares that are available for public trading are considered in the index calculation. The index is monitored via the ticker symbol R25I.

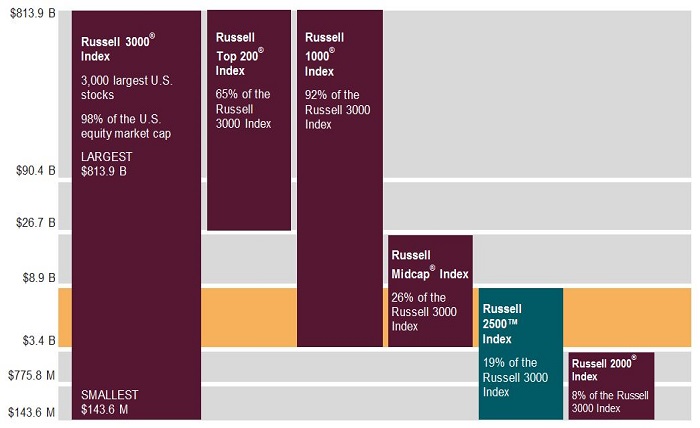

The Russell 2500 Index is a subset of the Russell 3000 Index, which covers about 98% of the US equity market. The Russell 3000 Index is divided into two sub-indexes: the Russell 1000 Index, which consists of the largest 1,000 companies in the Russell 3000 Index; and the Russell 2000 Index, which consists of the smallest 2,000 companies in the Russell 3000 Index. The Russell 2500 Index is composed of the smallest 500 companies in the Russell 1000 Index and all the companies in the Russell 2000 Index.

What are the Composition and Characteristics of the Russell 2500 Index?

The Russell 2500 Index comprises approximately 2,500 companies from various sectors and industries. As of June 30, 2023, the top five sectors by weight in the index were financial services (22.3%), producer durables (16.9%), consumer discretionary (15.8%), technology (14.6%), and health care (11.4%). The top five industries by weight in the index were banks (9.7%), software (6.4%), biotechnology (5.8%), specialty retail (4.8%), and industrial machinery (4.5%).

The Russell 2500 Index has some distinctive characteristics that differentiate it from other indexes. For instance, the index has a higher growth orientation than the broader market, as it includes more companies that are expected to have higher earnings growth rates than their peers. The index also has a higher risk profile than the larger-cap indexes, as it includes more companies that are subject to higher volatility, lower liquidity, and lower profitability than their peers. The index also has a lower dividend yield than the larger-cap indexes, as it includes more companies that reinvest their earnings rather than pay dividends to shareholders.

What are the Benefits of Investing in the Russell 2500 Index?

Investing in the Russell 2500 Index can offer several benefits to investors who are looking for exposure to the smid-cap segment of the US equity market. Some of these benefits are:

- Diversification: The Russell 2500 Index provides a broad and diversified exposure to a large number of companies from various sectors and industries. This can help reduce portfolio risk and enhance returns by capturing different sources of growth and value across the market spectrum.

- Performance: The Russell 2500 Index has historically outperformed the larger-cap indexes over long-term periods, as it includes more companies that have higher growth potential and innovation capabilities than their peers. For instance, from July 1, 1995, to June 30, 2023, the Russell 2500 Index had an annualized return of 12.6%, compared to 10.9% for the S&P 500 Index and 10.7% for the Russell 1000 Index.

- Accessibility: The Russell 2500 Index is widely followed and used by investors and fund managers as a benchmark for smid-cap investing. There are several investment products that track or replicate the performance of the index, such as mutual funds, exchange-traded funds (ETFs), or index funds. For example, one of the most popular ETFs that tracks the Russell 2500 Index is the iShares Russell Small/Mid-Cap ETF (IWR), which has over $13 billion in assets under management.

Conclusion

The Russell 2500 Index is a stock market index that tracks the performance of 2,500 small-cap and mid-cap companies in the United States. The index covers about 15% of the total US market capitalization and represents a broad and diversified exposure to the smid-cap segment of the US equity market. The index has a higher growth orientation, a higher risk profile, and a lower dividend yield than the larger-cap indexes. The index has historically outperformed the larger-cap indexes over long-term periods, as it includes more companies that have higher growth potential and innovation capabilities than their peers. The index is widely followed and used by investors and fund managers as a benchmark for smid-cap investing, and there are several investment products that track or replicate the performance of the index, such as mutual funds, ETFs, or index funds. Investing in the Russell 2500 Index can offer several benefits to investors who are looking for exposure to the smid-cap segment of the US equity market.